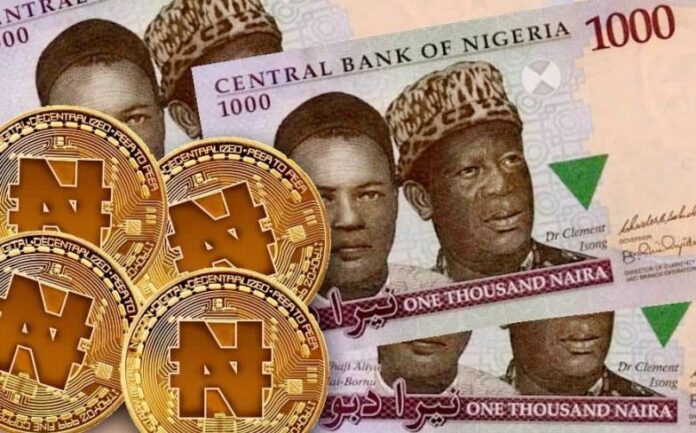

The platform on which the idea of the Central Bank of Nigeria (CBN) issues a digital currency that provides a unique form of money denominated in naira, generally known as” E-naira,” has finally arrived and implemented by the Nigerian government.

The Nigerian government cue into this platform because of its numerous objectives and the benefits the citizens will drive from the database.

Below are some reasons why the Nigerian government rolls out the e-naira digital platform.

1. To aid financial inclusion

The Nigeria government adopted the idea of digital currency, which utilizes blockchain technology due to its financial inclusion, and this means the method of giving out banking and other financial services to people.

The primary purpose of this objective is to give monetary assistance and solutions to economically deprived or underprivileged people.

It also means that people and businesses have the permission to use valuable and affordable financial products and services to meet their needs.

It also illustrates the supply of savings and loan services to the poor cheaply. Some of the benefits are credit, insurance, payment, savings, and many others.

2. To allow payment efficiency

Payment efficiency is another primary reason why the Nigerian government accepted the idea of e-naira.

The government believes that if this platform, known as e-naira, runs in Nigeria, it will help and prove in the smooth and continuous transaction and getting value for money on a level.

Again the method will also make it easier for people to make their payment with less stress and wasting time.

An example of this is that with the help of e-naira, one can quickly make payment by just scanning your QR codes.

The QR code is a machine-readable code that consists of an array of black and white squares typically used for storing information for reading by the camera on a Smartphone.

Due to this benefit, the Nigerian government decided to buy the idea of using e-mail to gain from the platform.

3. Improvement of revenue, tax collection, and social intervention

The idea of introducing this process by the government of Nigeria was to use the platform as a source of generating revenue and tax target as social interventions.

Nigeria’s government has strong feelings that e- naira will help the nation to improve in revenue generalization.

The e-naira platform, based on the government’s views, will help promote the programs designed to deliver social benefits and develop the human capital of specific target groups.

Examples of social intervention services include concrete services that have to do with income support, mental health services, transportation, legal services, in-home health services, socialization, and many others.

4. Diaspora payment

Diaspora payment can also be a remittance, and it is money sent to someone in a foreign country to their hometown.

Through the federal government, the central bank of Nigeria implemented this policy of e-naira to improve the receipt and administration of Diaspora remittance into Nigeria.

Again, the Nigerian government cued into this platform and idea to deepen the foreign exchange market, provide more liquidity, and create transparency.

They also believe that Diaspora payment or remittance, which happens to be one of the objectives of e-naira, will help poorer recipients meet basic needs.

Also, they have complete trust that it will help the fund cash and non-cash investments, both in finance education and will even foster new businesses.

Lastly, in line with the government, the CBN knows that it will facilitate service debt and give essentially drive economic growth.

5. Supports digital economy

E-naira will also play a good role in supporting the economy by using digital computing technologies.

It is an activity you can conduct business through the market based on the internet and the World Wide Web.

The Nigeria government had in mind that the new system adopted will foster more helping hands to the citizens in the area of the digital economy. For this reason, the method was approved and utilized by the Central Bank of Nigeria.

They believe that the idea will help firms cut an aspect of the retail chain and send personalized goods directly from the factory to the people instead of giving them to shops or retailers to pass it to consumers.

They know that idea will help lower the price of the goods and make them cheap.

6. Improve the effectiveness of monetary policy

Monetary policy is a set of actions a national central bank takes to control the overall money and sustainable economy.

The Nigeria government views e-naira as a means that will help them to improve the monetary policy effectively.

They intend to archive this aim using the e-naira platform to control the quantity of money available in Nigeria and the channels by which this money comes.

The tools used by the federal government to carry out these functions include reserving requirements; this process involves the CBN, checking up the number of funds that a bank holds in reserve to ensure that it can meet up problems in case there is an urgent reason for withdrawer.

Also, they use discount rates, which is the interest rate the federal reserve charges banks to borrow funds from them.

Finally, they use another tool known as open market operations; this policy has to do with the Central bank selling or buying Treasury securities to influence the size of banks’ reserves and the rates of their interest.

All these tools will help them to know the effective ways to manage the money supply in Nigeria.

7. Ensures monetary and price stability

In line with the government, the central bank of Nigeria feels that the e-naira platform introduced will maintain monetary and price stability.

Because we haven’t known the benefit of e-naira on making goods and services low, the platform will eradicate anything like price fluctuation or even inflation since it works effectively in other sectors.

Conclusion

We will all agree that the Nigerian government, in line with the Central Bank of Nigeria, has made a better decision by adopting and implementing the idea of the e-naira platform into the Nigerian sector.

By mare looking at the objectives and the benefit of e- naira, we will see that the country will go more digitalize through this platform.